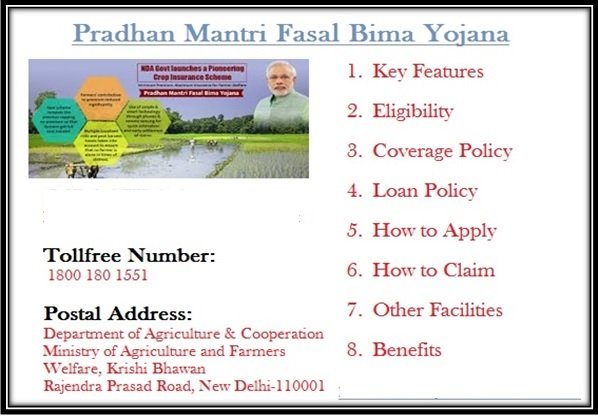

Pradhan Mantri Fasal Bima Yojana Online Registration 2022 Low Interest Rate Crop Insurance Scheme (Last date)] [Application Form, Eligibility, Documents, List, How to apply

The Pradhan Mantri Fasal Bima Yojana also known by the abbreviation PMFBY is a step that has been taken by the central government of the country(All the schemes of Central Government). It is a crop insurance scheme that has been designed by the government for assisting the farmers in receiving monetary assistance on the event of crop damage due to natural calamities. The farmers will have to pay low premiums for getting the insurance.

“”e-Nam Android App” has been launched by government for farmers of the country. “

“ “Krishi Rin Samadhan Yojana In Madhya Pradesh”, “Chhatrapati Shivaji Maharaj Shetkari Samman Yojana Maharashtra” have been launched as a loan waiver scheme for the betterment of the farmers in the states.

Pradhan Mantri Fasal Bima Yojana Details 2019

| 1 | Name | Pradhan Mantri Fasal Bima Yojana [Crop Insurance Scheme ] PMFBY |

| 2 | Announced Date | January, 2016 |

| 3 | Announced By | Current PM of the country, Narendra Modi |

| 4 | Supervised By | Department of Agriculture, Cooperation and Farmers Welfare |

| 5 | Target Audience | Country Farmers |

| 6 | Latest Last Date Of Application | 31 July |

| 7 | Official Site | https://pmfby.gov.in/ |

Previous Crop Insurance Scheme List | ||

| 1 | Name | Closed Date |

| 2 | Comprehensive Crop Insurance Scheme or CCIS | 1997 |

| 3 | Experimental Crop Insurance | 1997-1998 |

| 4 | Farm Income Insurance Scheme or FIIS | 2003-04 |

| 5 | National Agriculture Insurance Scheme or NAIS | 1999-2000 |

“Central has launched “Subsidies to Farmers under Various Government Schemes”,“Kisan Vikas Patra” and “Kisan Credit RuPay Card” for all farmers.”

Eligibility Criteria For PM Fasal Bima Yojana

No classification of farmers –

The desire of the government in providing the benefits of the scheme to as many farmers has possible, has encouraged them to eliminate any segregation or classification. Any farmer is welcome to be a part of the crop insurance scheme.

Ownership of land is not an issue –

Some of the prior schemes were only open for those farmers who owned the land. But the PMFBY is not like that. It will not take into consideration whether the farmer is the actual owners of the land or has it on a rental basis.

Safeguarding the non-loanee farmers –

The rules of the scheme highlight that if an agricultural labor has not applied for any other credit for framing purpose, then they will have to produce proper documents for being a part of the PMFBY. This kind of farmers is called non-loanee farmers.

“Government has launched “Pradhan Mantri Krishi Sinchai Yojana, and Krishi Sanjeevani Yojana Amnesty scheme.” for the good irrigation facility.”

Key Features Pradhan Mantri Fasal Bima Yojana

Knowing about the salient features of the scheme is a must if you are willing to take the advantages of the scheme:

A substitute for all other agro-based schemes –

The names of the previous schemes for farmers, has already been mentioned. With the successful implementation of the PMFBY, the central government is trying to bring all those schemes under one head. Farmers of all categories are allowed to enjoy the benefits of the scheme

Low premium rate –

The average farmers of the country are poor. It is not possible for them to ensure the safety of their crops by paying high crop insurance premiums. Under the PMFBY, they will need to pay low insurance premiums and thus, safeguarding their agro-investment will be easy. The premium rate 2% for Kharif crop, 1.5% for the Rabi crop and 5% for commercial crops.

Mode of payments –

Presence of an active bank account is a must as the government will pay the insurance money to the farmers, through the bank. The insurance money will be deposited to the bank account and then the farmers will be able to withdraw it.

Insurance coverage –

It has been mentioned that the insurance premium is less and the farmers will have to pay a fraction of the insured amount. But in case of a natural calamity, the farmers will be entitled to get the full amount that has been mentioned in the insurance policy.

Tax exemption –

Tax is levied by the government on any kind of investment. But for the betterment of the farmers, the government has decided to make the scheme tax free. It means that the farmers will not have to worry about any tax deductions.

Insurance Premium Calculator –

Premium calculation for acquiring the policy is not any easy task. But fear not as it can be accomplished easily by using the special feature called the “Insurance Premium Calculator.” It assists in churning out the premium amount a farmer needs to invest, depending on the type of crop.

Loan facility –

The reservation of acquiring any special credit for the betterment of the agricultural yield will not be possible against PMFBY program. The program is all the shied that the farmers require for securing the agricultural investments.

The facility of nomination –

As of now, the government has declared nothing about the process of nominating someone under the scheme. The farmer himself will be able to apply for the insurance policy.

Coverage of farmers and Crops in Fasal Bima Yojana

When discussing the coverage of farmers, you need to know about the two main components that have been highlighted in the draft of the PMFBY scheme.

- There are two main variables in this section. There is room for both the voluntary and the compulsory components. Alongside, there are reservations that will prove to be beneficial for the farmers who have access to ST/SC/OBC certificates.

- All those farmers who have already applied and received any kind of agricultural credit from the government or the banks will come under the scheme directly. Thus, these farmers are known as the compulsory competent of the scheme. It is imperative that the money be used for planting a seasonal crop. SAO credit is the full form of the seasonal crop cultivation loan.

- As for the voluntary component, this group comprises of the farmers or the agricultural workers who do not have any kind of credit to their name. By providing the adequate papers, these farmers can also become a part of the PMFBY.

Food crops as well as commercial crops can be insured under the PMFBY.

The list contains rice, wheat, pulses, millets, castor, groundnut, linseed, cashew nut, guava, banana, and mangoes. These are the crops that are grown by the farmers, in various parts of the country.

““Samajwadi Kisan Sarvhit Bima Yojana UP” and “Ushtra Vikas Yojana Rajasthan for camel production” have also been launched in the state.”

Risk Converge

Planting or prevented sowing risks –

Without proper rainfall, the sown seeds will not germinate. It will directly affect the crop production and incur loss for the farmers. If the farmer has suffered from losses or has not been able to plant the seeds due to low rainfall, the he will get the insurance claim.

Standing harvest risks –

The entire period after the planting of the seeds and the harvesting of the rip crop is called the standing period of the crops. Any crop failure that is caused due to the unforeseen circumstances, which are natural in character, will be incorporated within the policy regulations.

Post-yield risks –

The farmers require time for arranging the crop before extracting the final fruit. The time is referred to as the spreading or drying time. If the harvest is damaged due to natural forces, within a frame of two weeks, then the government will provide the farmers with the insurance money.

Localized mishaps –

No one can predict the mood of nature and neither can anyone predict the extent of the calamity. It so happens that a natural calamity only affects a certain part while the others remain unharmed. Cases like these will also be entitled to get the insurance money.

“”Paramparagat Krishi Vikas Yoajan” has also been launched by central for promoting organic farming in India.”

Risk Not Covered

Artificial or manmade reasons –

If the standing or the harvested crop is damaged by any artificial or manmade reason, then the farmer will not get the insurance money. For example, if the crops are destroyed due to the effects of the war of any nuclear fallout or radiation, then the insurance policy will not cover it.

Mending the damage of stolen crops –

It is the duty of the farmer to prevent the crops from being stolen. If someone sets the entire harvest on fire, then that too is the responsibility of the farmer. If any human interference and lack of protection has caused the damage to be done, it will fall outside the clearance of the insurance policy.

Damages caused by animals –

If the harvest is damaged by the action of domesticate or wild animals, the government will not pay for the damages. It is the responsibility of the farmer to take adequate measures for keeping the crops away from the clutches of the animals.

“ “UP Fasal Rin Mochan Yojana” has been launched by Yogi Adityanath as a loan waiver scheme in the state.”

Documents Required In Crop Insurance Scheme

The following documents are required for applying for the insurance scheme:

Land related documents –

Whether the farmer is planting on his own land or on rented land, he will have to produce proper land related documents. For successfully applying under the scheme, the farmers will have to prove that all legal papers of the land are in order.

Identity proof of the farmer –

The farmer will have to provide proper documents that will support the identification claims of the farmers. This can be met by producing any of the following papers – Aadhar Card, ratio card, PAN Card, Voter ID card etc. The document will provide the name, residential address of the farmer.

Bank account details –

It has already been mentioned that the insurance money will be directly transferred into the official bank account of the farmer. Thus, furnishing the details of the bank account is also mandatory.

Sowing declaration –

For acquiring the actual investment that the farmer has lost, he needs to notify the respective department about the value of the total crop. The paper that contains these details is called the sowing declaration. Producing this paper is a must. It will assist the authority in getting an estimated valuation and information on the kind of crop, planted on the land.

Aadhar Card –

The news regarding the necessity of the Aadhar Card in all aspects of the life of an Indian citizen has already been established. Thus, this unique code must also be furnished for the verification and authentication purpose by the authority. Read here Aadhar Government Notification For Pradhan Mantri Fasal bima Yojana.

Form of application –

last but not the least; all farmers who are interested in getting the benefits of the scheme will have to fill in an application form. If the application form is accepted by the authority, they will fall in the beneficiary list.

“Van Bandhu Kalyan Yojana has been launched by central for the well being of tribal”.

Bank or Agency Under the scheme

The central government will require the assistance of the selected banks and some reputed insurance companies for settling the claims under the PMBFY. Co-operative banks, Commercial banks, and Regional Rural Banks will play an important role in settling the insurance claims of the farmers. Few selected third party or private insurance companies will be given the permission of selling the claims, via the banks. The banks and selected agencies have been chosen to eliminate the presence of third party in the settlement process who charges a certain percentage from the farmers.

How to get application form for Pradhan Mantri Fasal Bima Yojana

It is true that the PMFBY is elaborate with many clauses. For acquiring a better understanding of the scheme, one can take a closer look at the official website of the program. To get to the website, you will have to click on the link http://agri-insurance.gov.in/.

Once you reach the website, you can click on the proper link that will provide you with the application form. By clicking on the link https://pmfby.gov.in/farmerRegistrationForm, the interested candidate will get the online application form.

How to Apply for Pradhan Mantri Fasal Bima Yojana (offline and online)

Both the online and offline modes of application are available. If you are more accustomed to the offline mode, you will have to click on the official website and then get the application form downloaded in a PDF format. Once the download is complete, you need to get a clear print out of the form. Fill in the details and attach the photocopy of the documents that have been asked by the authority. Once this has been done, you need to submit the form and wait for its approval.

After acquiring the information about the offline process of application, it is time to discuss about the online application procedure. For this, the interested candidate will have to follow the steps mentioned below:

- To get the online application form, the interested candidate will have to click on the authorized web link. When the page has opened, the link for acquiring the application form must be clicked.

- Clicking on the link that has been marked as “apply as farmer” will give you access to the form. As you get the form, you need to fill it accordingly. Make sure all the details are correct.

- Once the form fill up has been completed, the candidate must click on the “Submit” link. After the successful submission of the form, the site will generate an application code. Note it down as it might come in handy during the claim settlement process.

“You can read here “All Central Sarkari Yojana”.”

How to claim the insurance money under PMFBY

For claiming the insurance money, the farmers will have to make the application within two weeks of the damage. Apart from attaching the required legal papers, some complex figures must be churned for getting a clear idea about the damage done.

The two variables required are Actual Yield or the AY and the Threshold Yield i.e. TY. All the claim settlement will be done according to this calculation. The farmers have to prove that the years AY has been far below the TY. Only under this circumstance will the farmer be given the money.

Claims Payout = (Shortfall in Yield / Threshold Yield) * Sum Insured

For working out the actual quantity of the Shortfall in Yield, the claim verification agency must subtract the Threshold Yield amount from Actual Yield. The authority will take the final decision after doing the necessary calculations. If the farmers want to enhance the chances of getting the insurance money, they will have to be prompt in their action and keep all the documents duly updated. Providing the correct information is a must.

Documents List for Claiming

Claim form –

In case the farmer has incurred a heavy loss due to any natural calamity, he will have to submit a claim form. Before submitting the claim form, the farmer needs to make sure that all the details have been filled in correctly.

Land records –

Furnishing the legal documents, associated with the land on which the farming is done, must be attached with the claim form. It will help the respected authority in verifying the claims.

Information of the insurance company –

The farmers can opt to purchase crop insurance from other private companies as well. After the damage to the crop has been done, the owner of the crop will have to produce the papers of that insurance company or agency to the bank.

Certificate of Insurance –

The actual certificate of the insurance policy that was given to the farmer during the purchase of the policy, must be attached with the claim papers. It is the proof that the crop and the land were actually insured.

Photographs of crop damage –

Providing the verification authority with the proof of crop damage claims is a must. They will not believe the words of mouth. Thus, attaching two high-quality snaps of the damaged crop is a must.

Sowing certificates –

Just as during the application process, the farmer will have to attach a photocopy of the sowing certificate with the damage claim settlement papers. It is needed for some verification by the insurance company and the government authority.

“You can read here “All State Government Schemes”.”

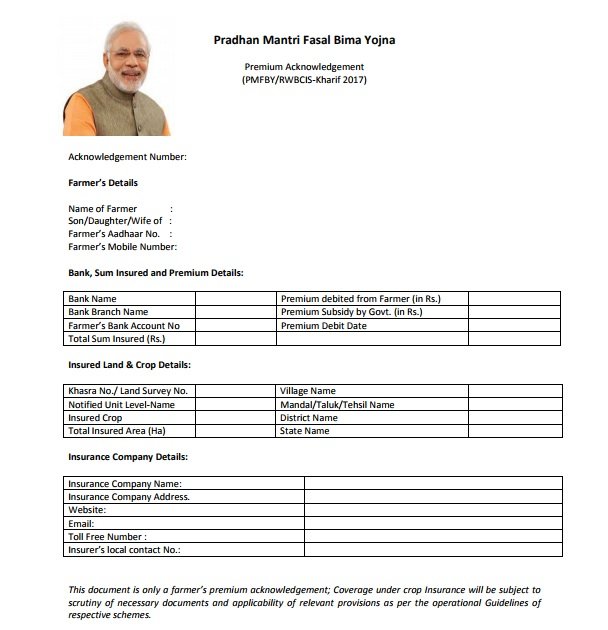

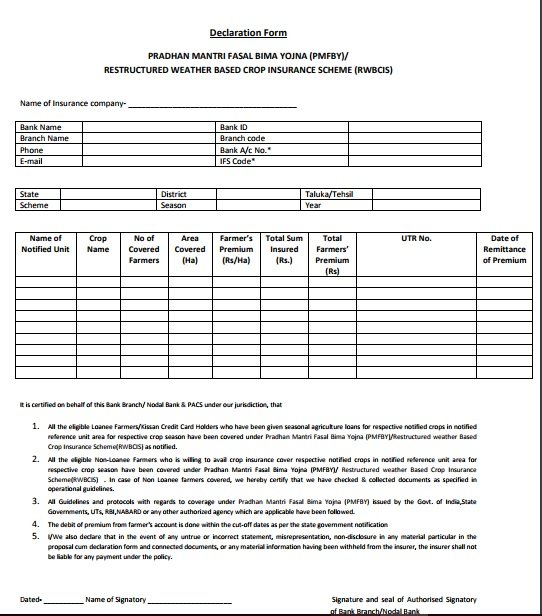

Other Important Form

Premium Acknowledgement Form

Declaration Form PMFBY

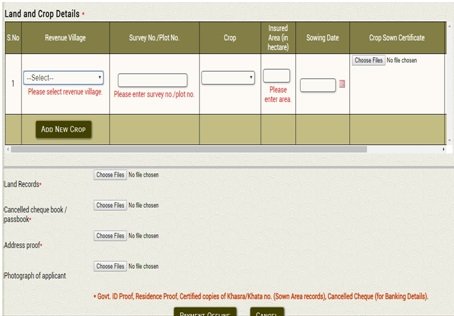

Add a new crop name under Fasal Bima Yojana

The crop planning is done in advance and then the farmer opts for the insurance. The amount of premium that the farmer will have to pay will depend directly on the crop he desires to sow. But what if the farmer has a change of mind? During the financial year of 2017 – 2018, the government has updated the scheme and added the provision of changing the crop preference.

Under this feature, the farmer who has already taken the crop insurance for one crop will get the facility of changing the crop name with another, at least 30 days prior to the cut-off day of purchasing or planting.

Process of changing the crop name Under the scheme

The farmer will have to log on to the official website and get to the application form link. Under the section that is marked as “Land and Crop Details” the farmer will have specify the name of the new crop. He will have to select the “Revenue Village” and then enter the plot number in the “Survey No./Plot No” column. He must then enter the name of the new crop. The next column will contain the total insured area in hectares. In “Sowing date” the farmer needs to specify the day of planting the seeds. The last column is marked as “Crop Sown Certificate.”

“You can read here “Agriculture Credit Fixed At 10 Lakh Crore ”.”

Official App for Pradhan Mantri Fasal Bima Yojana in Hindi and English

Recently, the Ministry of Agriculture, in cooperation with the IT sector has launched a mobile application for the program. The name of the app is ‘Crop Insurance App’ and it will assist the candidate in acquiring information on the various aspects of the scheme. Any person who has a smartphone that operates on the Android OS will be able to download the ‘Crop Insurance App’ from Google PlayStore. After downloading the application, it will be saved in the phone and one can gather information about the program.

Toll Free Number for Scheme

For all those who are not comfortable with the portal based operation or do not know how to operate the smartphone application, can get the details about the program in the traditional manner. By dialing the toll free number 1800 180 1551, the interested candidate will be able to talk to the customer care executives and acquire the info they seek.

“You can read here “All Uttra Pradesh Scheme”.”

Update

06/08/2018

Pradhan Mantri Fasal Bima Application Form Submission Ends on July 31

The last date of applying for the Crop Insurance Scheme initiated by the Prime Minister was July 26. But now, the dates have been extended, and the applying procedure will end on July 31. This decision has been made by the Centre on the request of the state government. Earlier the deadline for the submission of the online applications was scheduled to end today, i.e., July 26. The Crop Insurance Scheme or the Pradhan Mantri Fasal Bima focuses on providing financial support to the farmers. It also aims at offering insurance coverage. Stabilizing the income of farmers, the scheme ensures and encourages adopting the modern agricultural technology and offering innovative practices for farming. Interested applicants can submit their application before July 31.

14/08/2108

PM Crop Insurance Scheme Gets a New CEO

All central and state government need close monitoring. Thus, each department appoints high placed government officials at the head of the managing committee. The PM Crop Insurance Scheme will from now on be monitored by its new CEO, Ashish Kumar Bhutani. He will hold this office till May, 2020.

Other Schemes

- Mudra Loan Yojana

- Atal Pension Yojana

- Pradhan Mantri Jan Dhan Yojana

- LIC Pradhan Mantri Vaya Vandana Yojana

- Sukanya Samriddhi Yojana